Sector Rotation Strategy: Maximize Returns in Every Economic Cycle

Sector rotation strategy involves shifting investments into sectors expected to outperform based on the current phase of the economic cycle to maximize returns while mitigating risks.

The **sector rotation strategy** is a dynamic investment approach that aligns your portfolio with the ebbs and flows of the economic cycle, allowing you to capitalize on emerging opportunities and mitigate potential risks. This strategy involves shifting investments into sectors that are poised to outperform during specific phases of the economic cycle.

Understanding the Economic Cycle and Sector Performance

The economic cycle, a recurring pattern of expansion and contraction, significantly influences the performance of various sectors. Recognizing these patterns is crucial for implementing a successful sector rotation strategy. Each phase presents unique opportunities and challenges for investors.

The Four Phases of the Economic Cycle

The economic cycle typically consists of four distinct phases, each with its own characteristics and implications for sector performance. Understanding these phases is essential for making informed investment decisions.

- Expansion: Characterized by increasing economic activity, rising employment, and consumer confidence. Sectors like technology and consumer discretionary tend to thrive.

- Peak: Represents the height of economic activity, often followed by signs of slowing growth. Energy and materials sectors may outperform as inflation pressures build.

- Contraction: Marked by declining economic activity, rising unemployment, and decreasing consumer spending. Defensive sectors like healthcare and consumer staples tend to be more resilient.

- Trough: Represents the lowest point of economic activity, often signaling the beginning of a new expansion. Financials and industrials may lead the recovery.

By monitoring key economic indicators, investors can anticipate shifts in the economic cycle and adjust their sector allocations accordingly. This proactive approach is central to the sector rotation strategy.

Identifying Leading Indicators for Sector Rotation

Identifying leading indicators is crucial for anticipating economic shifts and making timely sector rotations. These indicators provide insights into the future direction of the economy, allowing investors to position their portfolios for optimal performance.

Key Economic Indicators to Watch

Several economic indicators can help investors gauge the current phase of the economic cycle and anticipate upcoming shifts. Monitoring these indicators regularly is essential for successful sector rotation.

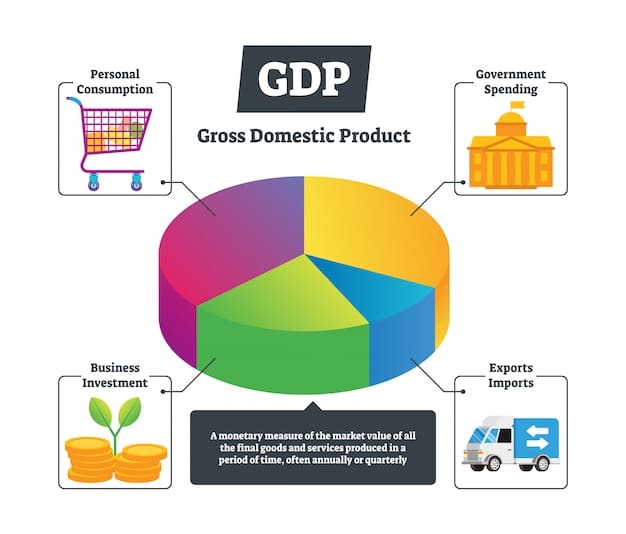

- GDP Growth: A measure of the overall economic output, indicating the pace of expansion or contraction.

- Inflation Rate: Indicates the rate at which prices are rising, influencing sector performance and monetary policy.

- Unemployment Rate: Reflects the health of the labor market, impacting consumer spending and economic growth.

- Interest Rates: Set by central banks, influencing borrowing costs and investment decisions across sectors.

Analyzing these indicators in conjunction with other economic data can provide a comprehensive view of the economic landscape and inform sector rotation decisions. Staying informed is key to making profitable adjustments.

Implementing a Sector Rotation Strategy

Implementing a sector rotation strategy requires a disciplined approach, a clear understanding of your investment goals, and a willingness to adjust your portfolio based on changing economic conditions. A well-defined strategy is crucial for success.

Steps to Effective Sector Rotation

Follow these steps to implement a sector rotation strategy effectively. Each step is designed to help you make informed decisions and optimize your portfolio for maximum returns.

- Assess Your Risk Tolerance: Determine your comfort level with risk, as sector rotation can involve frequent adjustments to your portfolio.

- Define Your Investment Goals: Clarify your objectives, such as capital appreciation or income generation, to guide your sector selection.

- Monitor Economic Indicators: Keep a close watch on key economic indicators to identify potential shifts in the economic cycle.

- Select Target Sectors: Choose sectors that are expected to outperform based on the current and anticipated economic conditions.

- Rebalance Your Portfolio: Adjust your sector allocations periodically to maintain alignment with your strategy.

By following these steps and staying disciplined, you can effectively implement a sector rotation strategy to enhance your portfolio’s performance. Remember to adapt your strategy as needed based on evolving economic conditions.

Choosing the Right Sectors for Each Phase

Selecting the appropriate sectors for each phase of the economic cycle is paramount to the success of a sector rotation strategy. Making informed decisions requires understanding which sectors historically thrive during certain periods.

Sector Performance by Economic Phase

Here’s a breakdown of which sectors typically perform well during each phase of the economic cycle. This guide can help you make sector rotation decisions based on the economic environment.

- Early Expansion: Technology, Consumer Discretionary, Financials

- Late Expansion: Industrials, Materials, Energy

- Early Contraction: Consumer Staples, Healthcare, Utilities

- Late Contraction: Financials, Basic Materials, Real Estate

Adjust your portfolio to favor these sectors in the corresponding phases to maximize potential returns. Analyzing historical data and current trends can refine your sector selections.

Risks and Challenges of Sector Rotation

While sector rotation can be a profitable strategy, it also presents risks and challenges that investors should be aware of. Understanding these potential pitfalls is essential for mitigating risk and maximizing returns.

Potential Drawbacks of Sector Rotation

Here are some of the risks and challenges associated with sector rotation:

- Timing the Market: Accurately predicting economic shifts can be difficult, leading to mistimed rotations.

- Transaction Costs: Frequent trading can incur significant transaction costs, eroding potential profits.

- Tax Implications: Short-term gains from frequent trading may be subject to higher tax rates.

- Over-Diversification: Spreading investments too thinly across multiple sectors can dilute returns.

Mitigating these risks involves careful analysis, disciplined execution, and a long-term perspective. A well-thought-out strategy is crucial for navigating these challenges successfully.

Examples of Successful Sector Rotation

Examining real-world examples of successful sector rotation can provide valuable insights and inspire confidence in the strategy. Learning from past successes can help you refine your investment approach.

Case Studies in Sector Rotation

Here are a few examples of how sector rotation has been successfully implemented:

- The Dot-Com Boom: Investors who rotated into technology stocks during the late 1990s benefited from the rapid growth of the internet sector.

- The 2008 Financial Crisis: Investors who shifted to defensive sectors like healthcare and consumer staples avoided significant losses during the market downturn.

- The Post-Recession Recovery: Investors who rotated back into financials and industrials early in the recovery phase capitalized on the rebound in economic activity.

These examples demonstrate the potential benefits of sector rotation when executed strategically and thoughtfully. Adapting your strategy to current market conditions is crucial for achieving similar success.

| Key Point | Brief Description |

|---|---|

| 📊 Economic Cycle | Understanding the four phases is crucial. |

| 📈 Leading Indicators | GDP, inflation, unemployment, and interest rates. |

| 🔄 Sector Rotation | Adjusting sectors based on economic phases. |

| ⚠️ Risks | Market timing and transaction costs. |

▼

Sector rotation is an investment strategy that involves shifting investments from one sector to another based on the stage of the economic cycle. It aims to capitalize on the sectors that are expected to outperform during specific economic periods.

▼

Sector rotation is important because it allows investors to potentially increase their returns by investing in sectors that are likely to benefit from the current economic environment. It also helps in mitigating risk by avoiding sectors that may underperform.

▼

The economic cycle typically consists of four phases: expansion, peak, contraction, and trough. Each phase has distinct characteristics and influences sector performance differently. Understanding these phases is key to successful sector rotation.

▼

Leading indicators include GDP growth, inflation rate, unemployment rate, and interest rates. Monitoring these indicators can provide insights into the future direction of the economy, helping investors make timely sector rotation decisions.

▼

The risks of sector rotation include the difficulty of timing the market, incurring transaction costs through frequent trading, potential tax implications from short-term gains, and the possibility of over-diversification, which can dilute returns.

Conclusion

In conclusion, the sector rotation strategy offers a dynamic approach to investing that can potentially enhance returns by aligning your portfolio with the economic cycle. By understanding the different phases, monitoring key indicators, and carefully selecting sectors, investors can navigate the complexities of the market and optimize their investment outcomes. However, it’s essential to be aware of the risks and challenges involved and to implement the strategy with discipline and a long-term perspective.