Maximize Your 2025 Tax Refund: A Guide to US Benefits Programs

Maximize Your Tax Refund: Claiming All Eligible US Benefits Programs in 2025 involves understanding various tax credits, deductions, and benefits programs available at the federal and state levels to reduce your tax liability and increase your refund.

Navigating the complexities of tax season can be daunting, but it also presents an opportunity to potentially maximize your tax refund: claiming all eligible US benefits programs in 2025. Many often overlook available tax credits and deductions that could significantly increase their refund. This article serves as a guide to help you identify and claim all the US benefits programs you’re entitled to, leading to a more substantial return.

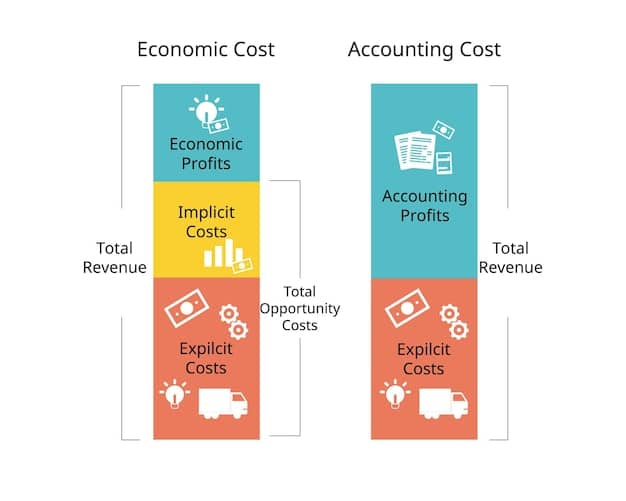

Understanding Tax Credits vs. Tax Deductions

Tax credits and tax deductions are both valuable tools that can help reduce your overall tax liability. However, they work differently and have different impacts on your tax refund. Understanding the nuances between the two is crucial for effective tax planning.

Tax Credits Explained

A tax credit directly reduces the amount of tax you owe, dollar for dollar. For example, if you owe $1,000 in taxes and qualify for a $500 tax credit, your tax liability is reduced to $500.

Tax Deductions Explained

A tax deduction, on the other hand, reduces your taxable income. The amount of tax savings depends on your tax bracket. For instance, if you’re in the 22% tax bracket and take a $1,000 deduction, you’ll reduce your taxes by $220.

- Tax credits provide a dollar-for-dollar reduction in your tax liability.

- Tax deductions reduce your taxable income, with the tax savings depending on your tax bracket.

- Credits are generally more valuable for low-to-moderate income individuals.

Knowing whether to prioritize credits or deductions can significantly impact your tax strategy.

Key Federal Tax Credits to Consider

The federal government offers numerous tax credits designed to provide financial relief for various situations. Identifying the credits you qualify for can substantially reduce your tax bill and increase your refund.

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit (EITC) is designed for low-to-moderate-income workers and families. The amount of the credit depends on your income and the number of qualifying children you have.

Child Tax Credit (CTC)

The Child Tax Credit (CTC) provides a credit for each qualifying child. The CTC can be partially refundable, meaning you may receive a portion of the credit back as a refund even if you don’t owe any taxes.

- The EITC is for low-to-moderate income workers and families, based on income and number of children.

- The CTC provides a credit for each qualifying child, with a portion potentially refundable.

- Education credits like the American Opportunity Tax Credit (AOTC) can help offset the costs of higher education.

Taking advantage of these federal tax credits requires careful consideration of eligibility requirements and proper documentation.

Exploring Common Tax Deductions

Tax deductions can lower your taxable income, leading to a lower tax bill. Understanding the different types of deductions can help you identify areas where you can reduce your tax liability.

Standard Deduction vs. Itemized Deductions

Taxpayers can choose between taking the standard deduction, a fixed amount based on their filing status, or itemizing deductions by listing individual expenses. The best approach depends on whether your itemized deductions exceed the standard deduction amount.

Common Itemized Deductions

Common itemized deductions include medical expenses exceeding 7.5% of your adjusted gross income (AGI), state and local taxes (SALT) up to $10,000, mortgage interest, and charitable contributions. Keeping detailed records is crucial for substantiating these deductions.

Choosing between the standard deduction and itemizing can significantly impact your tax outcome. Make sure to calculate both options to determine which yields the greatest tax savings.

US Benefits Programs related to Education

Education-related expenses can often be a significant financial burden. Fortunately, several US benefits programs can help offset these costs through tax credits and deductions.

American Opportunity Tax Credit (AOTC)

The American Opportunity Tax Credit (AOTC) is available for students pursuing the first four years of higher education. It covers qualified education expenses, such as tuition, fees, and course materials.

Lifetime Learning Credit (LLC)

The Lifetime Learning Credit (LLC) is available for students taking courses to improve job skills or pursue a degree. Unlike the AOTC, the LLC is not limited to the first four years of college.

- The AOTC is for the first four years of higher education, covering tuition, fees, and course materials.

- The LLC is for students taking courses to improve job skills or pursue a degree, without time limits.

- Student loan interest deduction allows you to deduct interest paid on qualified student loans, reducing your taxable income.

Understanding and claiming education-related benefits programs can provide substantial tax relief.

Healthcare Benefits Programs and Tax Advantages

Healthcare expenses can be substantial, but several US benefits programs offer tax advantages to help offset these costs. Understanding these programs can lead to significant savings.

Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are tax-advantaged savings accounts that can be used for qualified medical expenses. Contributions to an HSA are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

Medical Expense Deduction

You may be able to deduct medical expenses that exceed 7.5% of your adjusted gross income (AGI). This includes expenses for medical care, dental care, and vision care.

Leveraging these healthcare benefits programs can provide tax advantages while managing healthcare costs.

State-Level Benefits Programs and Tax Credits

In addition to federal programs, many states offer their own benefits programs and tax credits, which can further reduce your tax liability. These programs vary widely by state, so it’s essential to check what’s available in your state.

State-Specific Tax Credits

Many state-specific tax credits are available, such as property tax credits, rent credits, and credits for energy-efficient home improvements. Check your state’s tax agency website for a complete list of available credits.

State-Specific Deductions

Some states also offer deductions that are not available at the federal level, such as deductions for contributions to state-sponsored college savings plans or deductions for certain types of business expenses.

Don’t overlook potential tax savings offered by your state’s benefits programs and credits.

| Key Point | Brief Description |

|---|---|

| 💰 Tax Credits | Directly reduce your tax liability, dollar-for-dollar. |

| ✏️ Tax Deductions | Reduce your taxable income, affecting your tax bracket. |

| 🎓 Education Credits | Help offset costs of higher education like tuition and fees. |

| ⚕️ Healthcare Savings | HSAs and medical deductions provide tax advantages for healthcare expenses. |

Frequently Asked Questions (FAQ)

▼

A refundable tax credit can result in a refund even if you don’t owe any taxes, while a non-refundable tax credit can only reduce your tax liability to zero. Any remaining amount is not refunded.

▼

Calculate your itemized deductions and compare the total to the standard deduction amount for your filing status. Choose whichever is higher to reduce your taxable income.

▼

Qualified expenses include tuition, fees, and course materials required for enrollment or attendance at an eligible educational institution during the first four years of higher education.

▼

No, you cannot contribute to an HSA if you are enrolled in Medicare. However, you can still use funds from an existing HSA for qualified medical expenses after enrolling in Medicare.

▼

Visit your state’s tax agency website for a complete list of available credits and deductions, as well as eligibility requirements and instructions on how to claim them.

Conclusion

Maximizing your tax refund by claiming all eligible US benefits programs in 2025 requires careful attention to detail and thorough research. By understanding the differences between tax credits and deductions, exploring federal and state-level benefits programs, and keeping accurate records, you can optimize your tax strategy and potentially receive a larger refund. Make sure to consult with a tax professional for personalized advice tailored to your specific financial situation.