Maximize Your 2025 Social Security Benefits: A Step-by-Step Guide

Maximizing your Social Security benefits in 2025 involves strategic planning, considering factors such as your earnings history, claiming age, and understanding how spousal or survivor benefits may apply to your situation, ensuring a financially secure retirement.

Are you planning for retirement and wondering how to make the most of your Social Security benefits? This step-by-step guide, **How to Maximize Your 2025 Social Security Benefits: A Step-by-Step Guide**, will provide you with actionable strategies to help you secure a financially stable future.

Understanding the Basics of Social Security

Social Security is a crucial component of retirement planning for many Americans. Understanding how it works is the first step toward maximizing your benefits. Let’s delve into the key aspects you need to know.

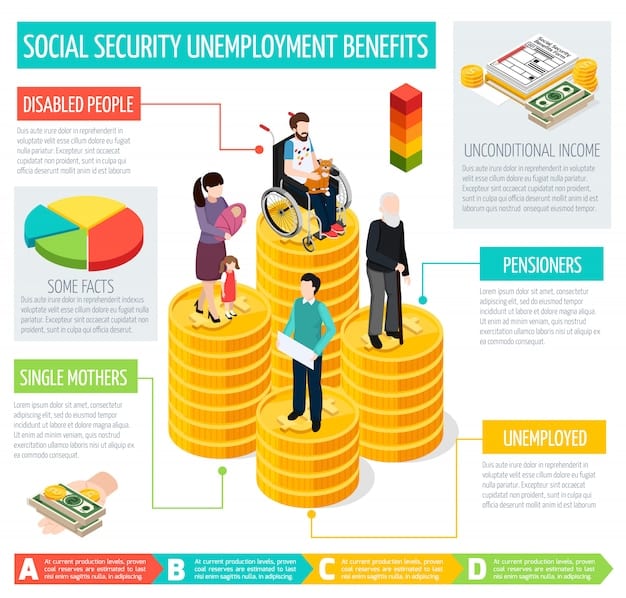

The Social Security Administration (SSA) oversees this federal program, which provides benefits to retirees, disabled individuals, and survivors of deceased workers. Your benefits are primarily based on your earnings history.

How Your Benefits Are Calculated

Your Social Security benefits are calculated using a formula that considers your highest 35 years of earnings. These earnings are indexed to account for changes in average wages over time.

- AIME (Average Indexed Monthly Earnings): The SSA calculates your AIME by averaging your indexed earnings over your 35 highest-earning years.

- PIA (Primary Insurance Amount): The PIA is the benefit you would receive if you retire at your full retirement age (FRA). It’s calculated using a formula applied to your AIME.

- Benefit Adjustments: Your actual benefit amount may be adjusted based on when you choose to start receiving payments. Claiming earlier than your FRA reduces your benefit, while claiming later increases it.

Understanding these calculations can help you estimate your future benefits and make informed decisions about when to retire.

In summary, Social Security benefits are calculated based on your earnings history and the age at which you claim. A higher AIME and delaying your claim can significantly increase your monthly payments.

Determining Your Full Retirement Age (FRA)

Your Full Retirement Age (FRA) is a critical factor in determining the amount of your Social Security benefits. It’s the age at which you’re entitled to receive 100% of your Primary Insurance Amount (PIA).

The FRA varies depending on the year you were born. For those born between 1943 and 1954, the FRA is 66. It gradually increases to age 67 for those born in 1960 or later.

FRA Chart by Birth Year

Here’s a quick reference chart to help you determine your FRA:

- Born 1943-1954: Age 66

- Born 1955: Age 66 and 2 months

- Born 1956: Age 66 and 4 months

- Born 1957: Age 66 and 6 months

- Born 1958: Age 66 and 8 months

- Born 1959: Age 66 and 10 months

- Born 1960 or later: Age 67

Knowing your FRA is essential because it serves as a benchmark for deciding when to start receiving benefits. Claiming before your FRA results in a reduced benefit, while claiming after your FRA can increase your benefit.

Understanding your FRA is a key step in planning your retirement and maximizing your Social Security benefits. It provides a clear timeline for making informed decisions about claiming age.

The Impact of Claiming Age on Benefits

One of the most important decisions you’ll make regarding Social Security is when to start claiming benefits. Your claiming age significantly impacts the amount you receive each month.

You can start receiving Social Security benefits as early as age 62, but doing so will result in a permanent reduction in your monthly payments. Conversely, delaying your claim beyond your FRA can increase your benefits.

Early vs. Delayed Retirement

Let’s explore the effects of claiming early or delaying your retirement:

- Claiming Early (Age 62): If you claim at age 62, your benefits could be reduced by as much as 30% compared to what you would receive at your FRA.

- Claiming at FRA: Claiming at your FRA (e.g., age 67 for those born in 1960 or later) entitles you to 100% of your PIA.

- Delayed Retirement (Up to Age 70): For each year you delay claiming beyond your FRA, your benefits increase by 8% per year, up to age 70. This can result in a significantly higher monthly payment.

Choosing the right claiming age depends on your individual circumstances, including your financial needs, health, and life expectancy. Consider your options carefully to make the best decision for your situation.

In conclusion, your claiming age is a crucial factor in determining your Social Security benefits. Weigh the pros and cons of claiming early, at your FRA, or delaying to maximize your potential income.

Strategies to Increase Your Social Security Benefits

There are several strategies you can employ to increase your Social Security benefits. These strategies involve careful planning and an understanding of how the system works.

One of the most effective ways to increase your benefits is to work longer. Each additional year of earnings can increase your AIME, leading to a higher PIA.

Maximizing Your Earnings

Here are some strategies to maximize your earnings years:

- Work Longer: Extending your career by a few years can significantly increase your AIME and overall benefits.

- Increase Your Income: Negotiate for higher pay, seek promotions, or pursue additional income streams to boost your earnings.

- Correct Earnings Records: Ensure your earnings records with the SSA are accurate. If you find errors, contact the SSA to correct them.

Another strategy is to coordinate with your spouse. Spousal benefits can provide additional income, especially if one spouse has significantly lower earnings.

In summary, increasing your earnings and coordinating with your spouse are effective strategies to maximize your Social Security benefits. These steps can lead to a more financially secure retirement.

Understanding Spousal and Survivor Benefits

Social Security offers spousal and survivor benefits, which can provide financial support to eligible family members. Understanding these benefits is important for comprehensive retirement planning.

Spousal benefits are available to individuals who are married to someone entitled to Social Security retirement or disability benefits. Survivor benefits are available to surviving spouses and dependents of deceased workers.

Eligibility for Spousal Benefits

To be eligible for spousal benefits, you must meet certain requirements:

- Be at least 62 years old or caring for a child under age 16.

- Be married to someone entitled to Social Security retirement or disability benefits.

- Your benefit amount is typically capped at 50% of your spouse’s PIA, but it may be reduced if you claim before your FRA.

Eligibility for Survivor Benefits

Survivor benefits are available to surviving spouses, children, and dependent parents of deceased workers. The eligibility requirements and benefit amounts vary depending on the relationship to the deceased and their ages.

In conclusion, spousal and survivor benefits can provide crucial financial support to eligible family members. Understanding these benefits can help ensure a more secure financial future for you and your loved ones.

Planning and Claiming Strategies for 2025

As you approach 2025, it’s essential to develop a solid plan for claiming Social Security benefits. This plan should consider your individual circumstances, financial needs, and retirement goals.

Start by estimating your potential benefits using the SSA’s online calculator. This tool can provide a rough estimate of your PIA and projected benefits at different claiming ages.

Steps to Plan Your Claiming Strategy

Follow these steps to create an effective claiming strategy:

- Estimate Your Benefits: Use the SSA’s online calculator to estimate your PIA and projected benefits.

- Evaluate Your Financial Needs: Assess your retirement expenses and determine how much income you’ll need from Social Security and other sources.

- Consider Your Health and Life Expectancy: Your health and life expectancy can influence your decision about when to claim Social Security.

- Consult with a Financial Advisor: A financial advisor can provide personalized guidance and help you make informed decisions about your claiming strategy.

| Key Point | Brief Description |

|---|---|

| 👴 Claiming Age | Claiming later can significantly increase your benefits. |

| 💼 Earnings History | Maximize earnings to increase AIME and PIA. |

| ❤️ Spousal Benefits | Understand eligibility for additional support. |

| 📊 Financial Plan | Integrate with overall retirement planning. |

Frequently Asked Questions (FAQ)

▼

The earliest age you can start receiving Social Security retirement benefits is 62. However, claiming at this age will result in a permanent reduction in your monthly payments.

▼

Your benefit is based on your highest 35 years of earnings, adjusted for inflation. The Social Security Administration (SSA) uses this earnings record to calculate your Primary Insurance Amount (PIA).

▼

Your FRA is the age at which you are entitled to receive 100% of your Social Security benefit. For those born in 1960 or later, the FRA is 67.

▼

Yes, for each year you delay claiming Social Security beyond your FRA, your benefits increase by 8% per year, up to age 70. This can significantly increase your monthly payments.

▼

Yes, Social Security offers spousal and survivor benefits to eligible individuals. Spousal benefits are available to those married, and survivor benefits are available to surviving spouses and dependents.

Conclusion

Maximizing your Social Security benefits for 2025 involves a combination of strategic planning, understanding your eligibility, and making informed decisions about when to claim. By taking the time to assess your financial situation and consider your options, you can secure a more financially stable retirement.